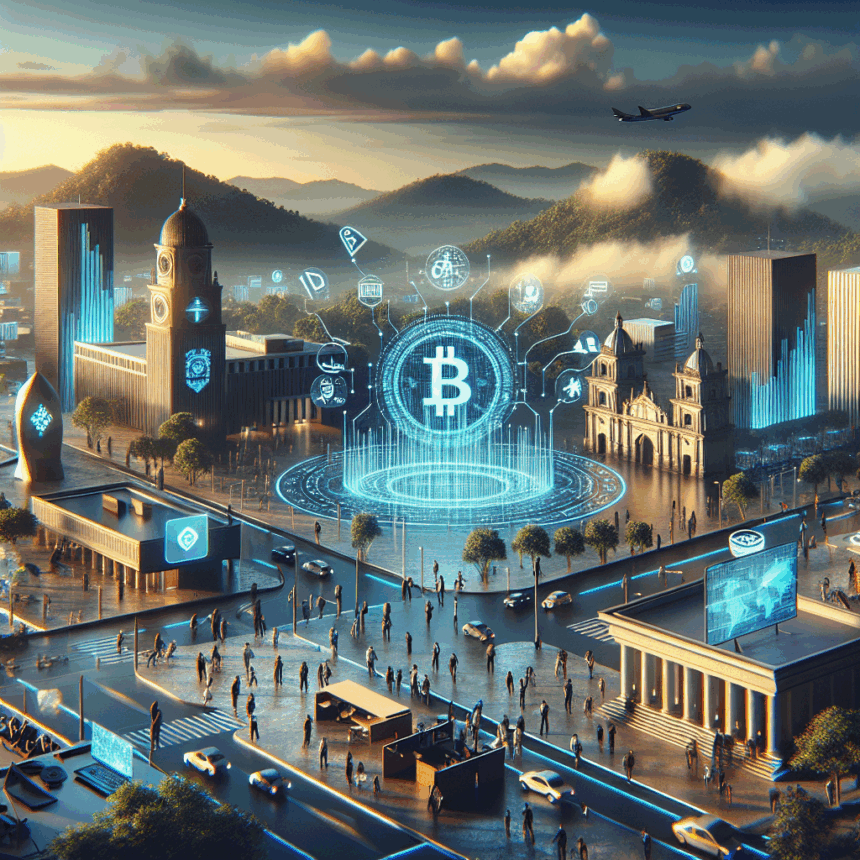

El Salvador Bitcoin Law: Institutional Shift

El Salvador’s recent amendments to its Bitcoin law are signaling a pivotal institutional shift in the nation’s cryptocurrency strategy. What began as a bold experiment in retail adoption is now clearly reorienting towards attracting significant institutional investment. This strategic pivot underscores a maturing approach to digital assets within the Salvadoran economic framework.

The Rundown

The core of this new direction lies in a concerted effort to create a regulatory and economic environment more conducive to large-scale capital. Rather than primarily focusing on everyday transactions and individual wallet adoption, the government is now actively courting global financial institutions, asset managers, and corporate treasuries. This pivot seeks to leverage Bitcoin’s potential beyond just a medium of exchange, viewing it as a powerful tool for economic development and capital attraction.

The Background

El Salvador made history in September 2021 by becoming the first country to officially recognize Bitcoin as legal tender. This ambitious step was initially aimed at driving financial inclusion and reducing remittance costs for its citizens. While the initial retail push saw varying degrees of success and public adoption, the broader economic benefits from this initial strategy proved challenging to fully realize.

Why It Matters

This strategic recalibration holds immense implications for El Salvador’s future economic landscape. By targeting institutional capital, the nation aims to unlock new avenues for infrastructure development, job creation, and long-term financial stability. It also sets a potential precedent for other sovereign nations considering deeper integrations of digital assets, demonstrating a pragmatic evolution from initial experimentation.

Key Takeaways

- El Salvador is shifting its Bitcoin strategy from retail adoption to attracting institutional investment.

- The primary goal is to draw large-scale capital for national economic development and stability.

- This represents a significant maturation of the nation’s approach to integrating digital assets.

- It could serve as a new blueprint for other countries exploring comprehensive cryptocurrency adoption.

What’s Next?

The success of this institutional shift will hinge on several factors, including ongoing regulatory clarity, sustained investor confidence, and global market conditions. El Salvador’s government will need to demonstrate a consistent commitment to fostering a stable and attractive environment for institutional players. This strategic evolution could potentially redefine the role of digital assets in national economies, moving beyond speculative retail interest to substantial, long-term investment.